Advanced Volume Profile Course

Welcome to the Advanced Volume Profile Analysis Course! This course is designed for traders of all levels who want to master the art of volume profile analysis, a powerful trading technique used by professional traders around the world. With this course, you’ll learn everything you need to know about volume profile analysis, how it works, and how to use it to make more informed trading decisions in the markets.

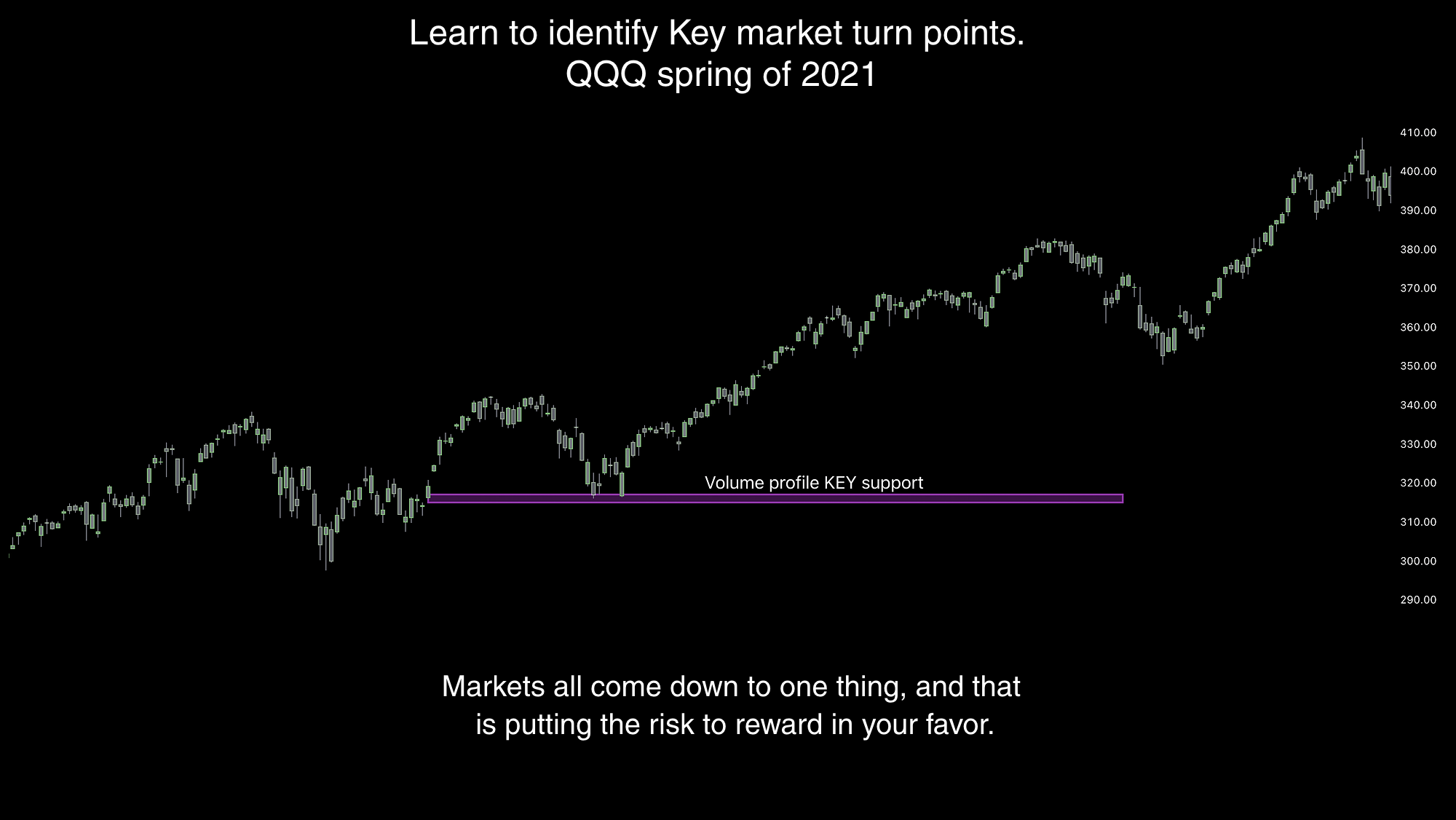

Learn to identify market turn points

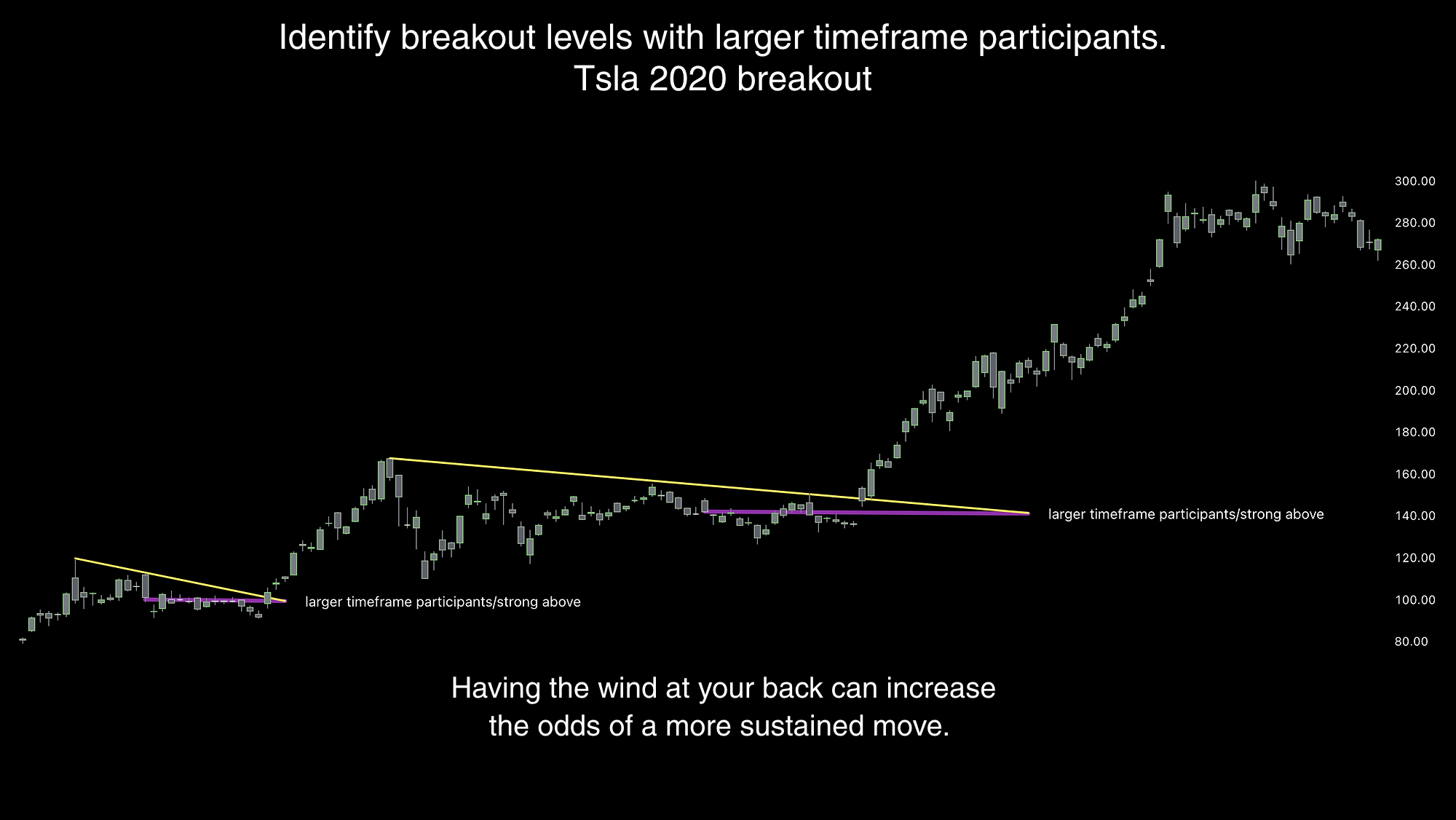

Learn to identify Breakout levels

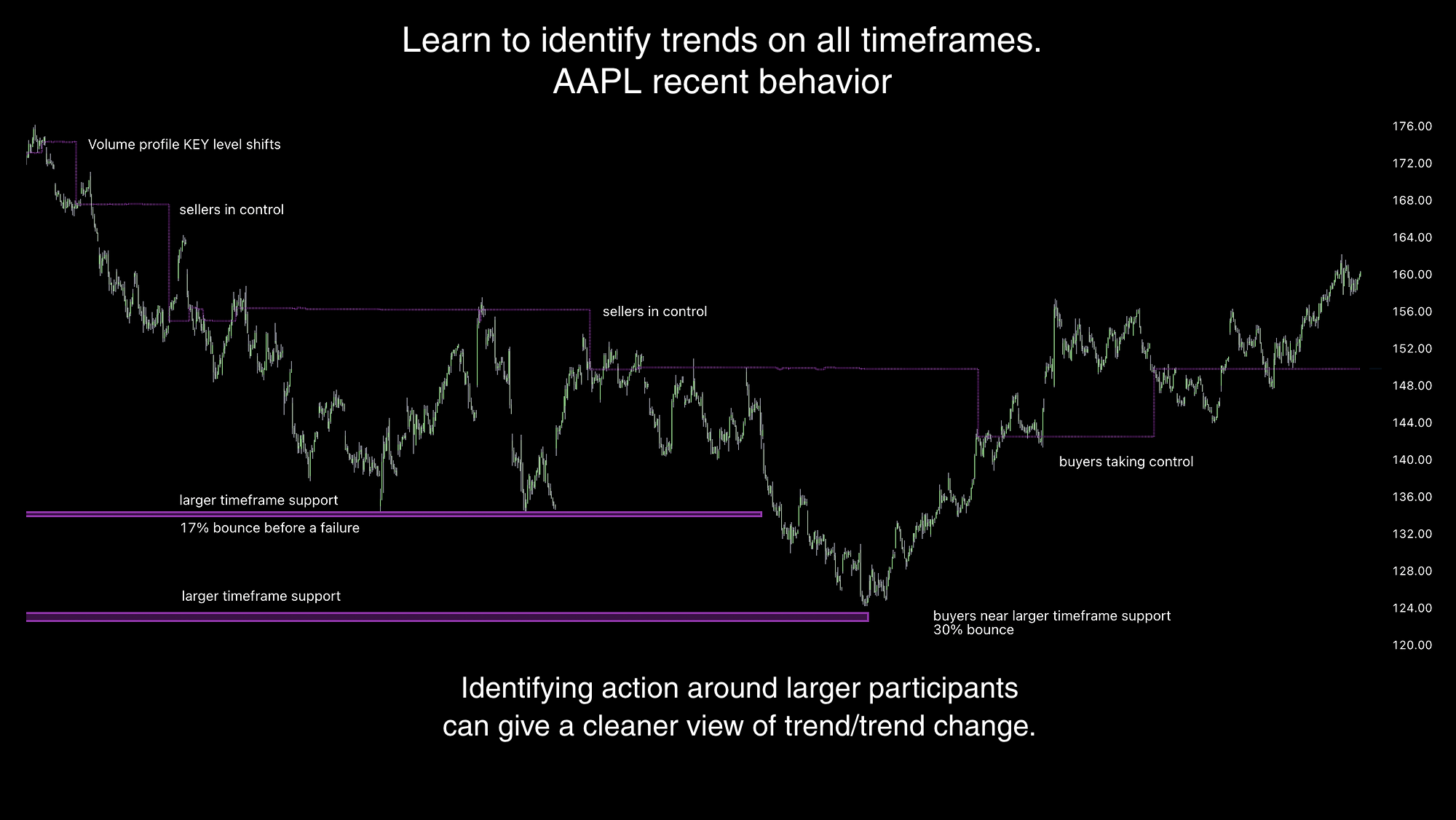

Learn to identify multi-timeframe trends

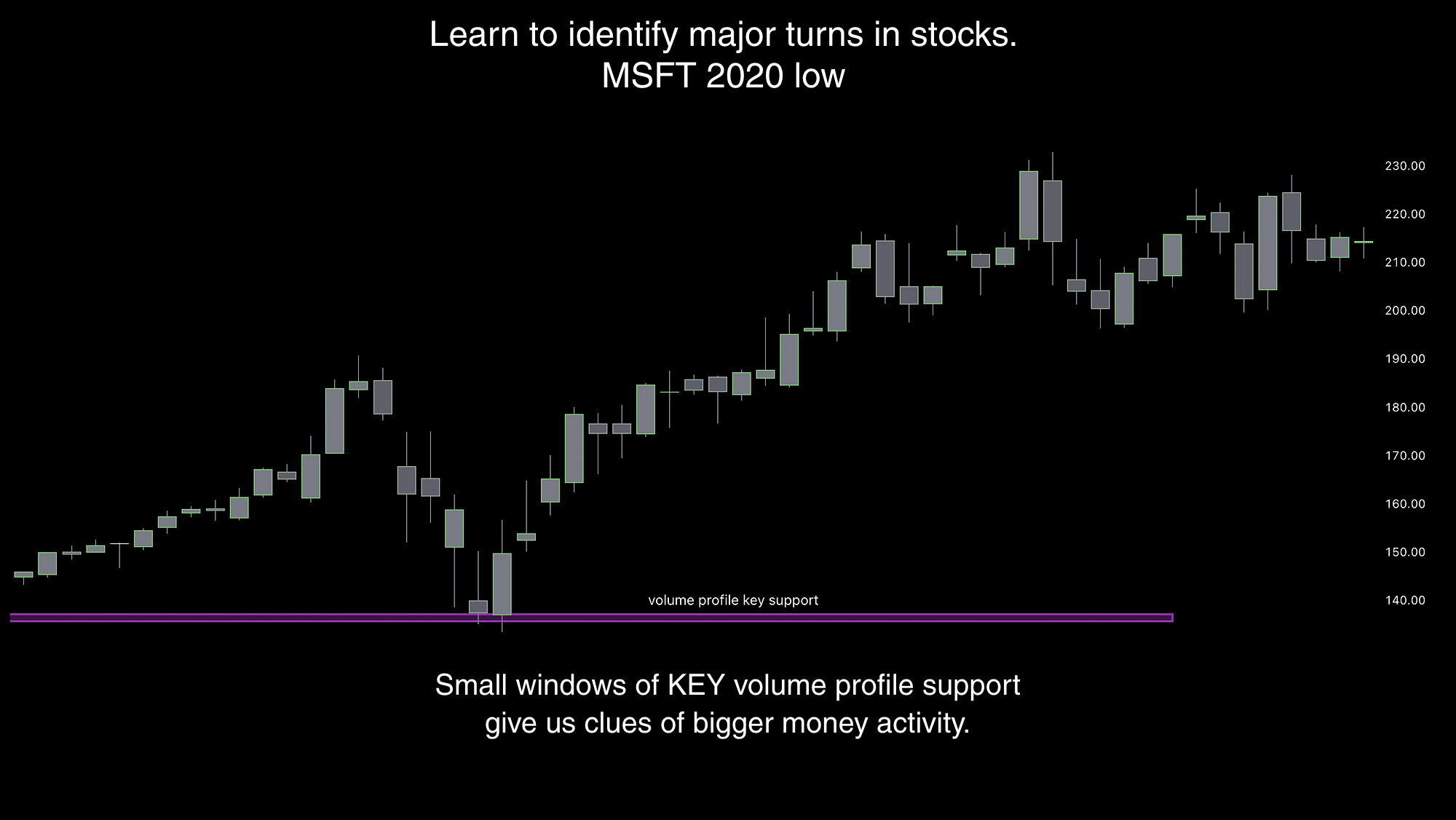

Learn to identify major turns in stocks

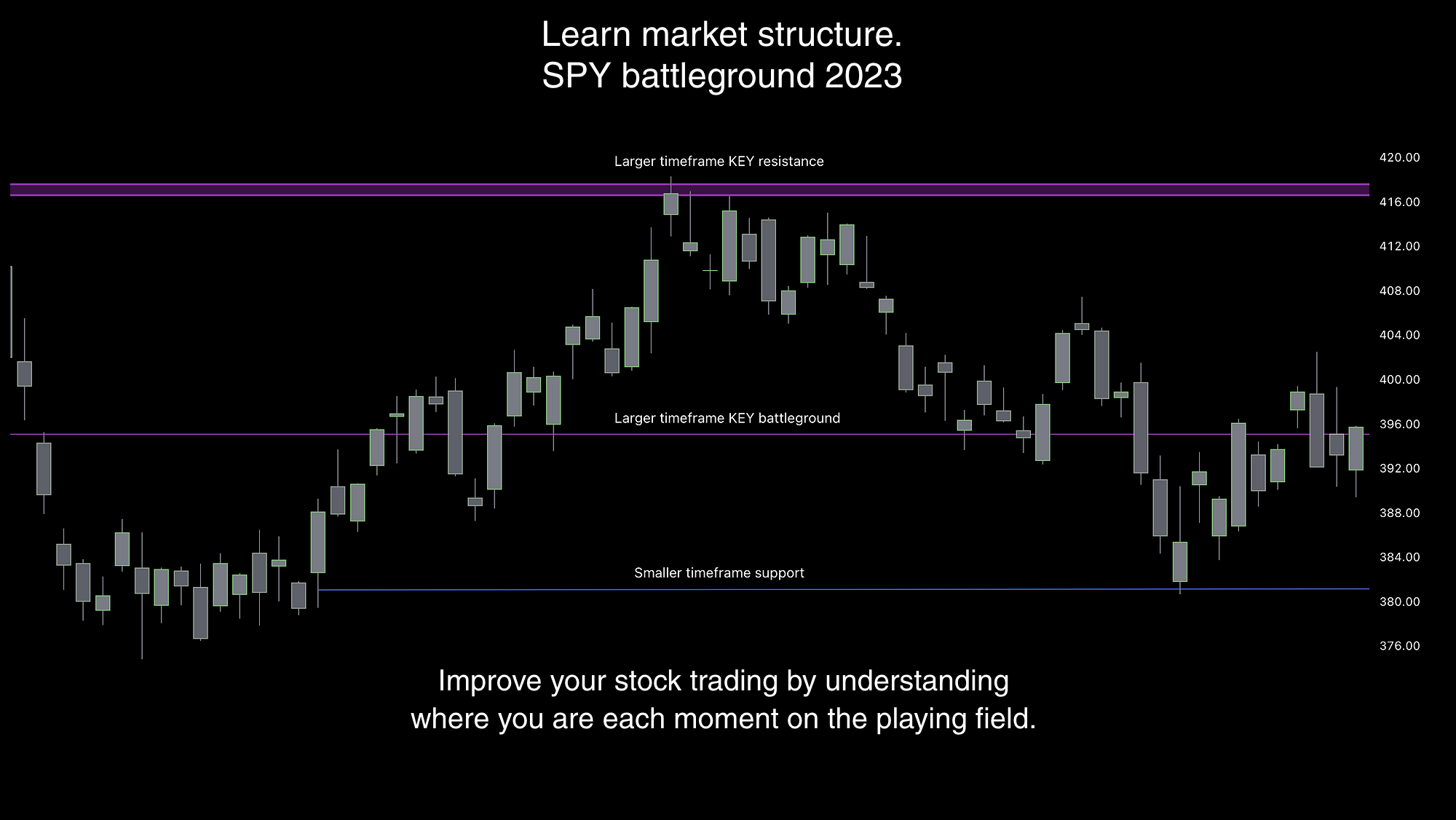

Learn to identify market sturcture

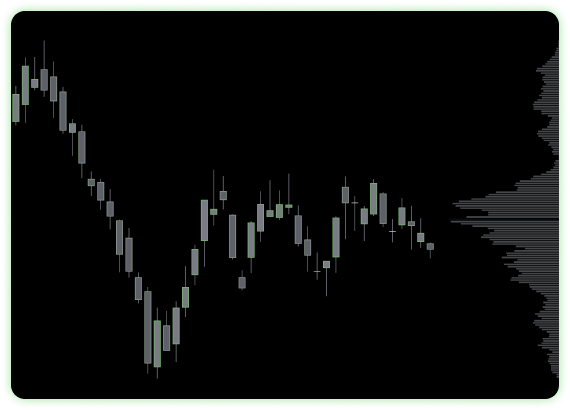

What is Volume Profile Analysis?

Volume profile analysis is a trading technique that analyzes the volume traded at each price level in a market. It provides a detailed understanding of the market’s behavior, revealing areas of powerful support and resistance, and giving traders an insight into where larger participants may be active. Volume profile analysis can be used in any market, including stocks, ETFs and futures. It can also be used across all timeframes, from longer term positioning, swing trading, even down to intraday.

Why Volume Profile Analysis is Important

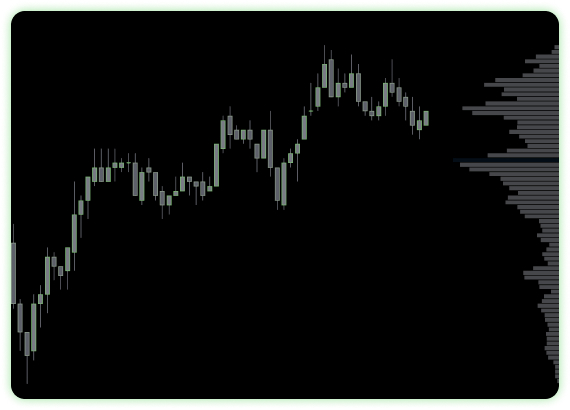

Volume profile analysis is an essential tool for traders who want to make better trading decisions. Traditional technical analysis focuses on price action, but volume profile analysis takes into account the volume traded at each price level, providing a more complete picture of the market’s behavior. Volume profile analysis helps traders identify areas of support and resistance, as well as overall trend. These levels can provide excellent trading opportunities, and traders who can identify them will have an edge in the markets.

Volume profile Key levels

One of the most critical applications of volume profile analysis is identifying support and resistance levels in the market. By analyzing the volume traded at each price level, we can identify KEY zones that have the advantage of producing larger risk to reward moves in the market. It also identifies critical areas in the market which can act like magnets. These levels can provide critical insights into the market’s behavior, and traders who can identify them will have an edge in the markets.